System #13: A Single Tax

The following are ideas taken from Henry George's book, Prosperity and Poverty where he attempts to outline the causes of poverty and provide a solution for it.

What is Wealth?

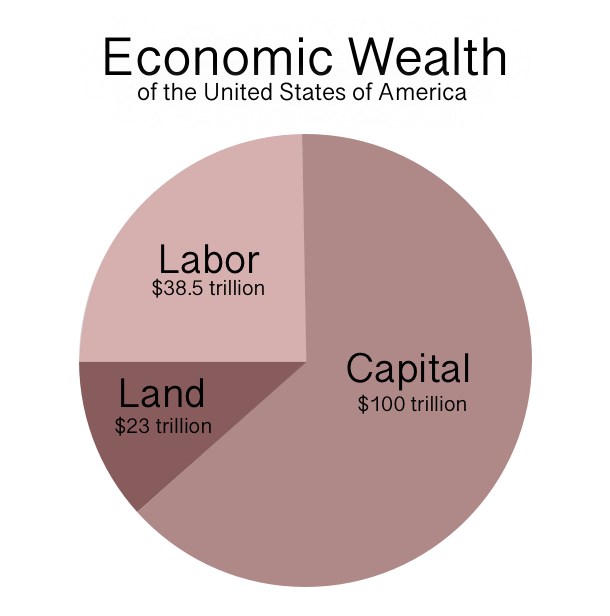

Wealth, according to Henry George, is three things: Labor, Capital, and Land. Each of which create a temporal version of themselves.

Labor - encompasses all productive activities performed by humans, whether manual (such as farming or factory work) or intellectual (such as planning, management, or invention). Labor gives rise to wages

Capital - in George's view, is wealth that has already been produced and is set aside for further production. This includes not only physical tools and equipment but also money when it is invested in productive activities (e.g., buying machines or raw materials). Capital gives rise to interest.

Land - includes all elements of the natural world that exist without human intervention. This encompasses the earth’s surface, air, oceans, rivers, minerals, and other natural resources. Land is the source from which all wealth is made. Everything that has been created was made from land. Land give rise to rent.

Capital, itself, is self-regulating. When the economy has a lot of capital, it is generally cheaper to borrow capital than when the economy does not. Therefore, while it wanes and waxes, capital stays within that cycle.

Wages, taken by themselves, should be self-regulating. When there's an excess of workers, wages go down, and when there's a need for them, wages go up.

Rents, as well, should go up when there's demand, and go down when the demand wanes, but that doesn't happen. The constant growth of cities and its resulting speculation of land prices pushes rents up, and up, and up.

The interesting thing is that these three "expenses" all fight for the same pie. As one grows larger, the others grow smaller. Since interest is self-regulating, it leaves wages and rents to fend for themselves. And unfortunately, rents win.

Is Poverty is Caused by Population?

You might think, as has been thought before, that poverty has it's roots in over-population, but you would be wrong. Henry George gives us an example:

Imagine a man takes a plot of land and starts to farm it, with no neighbors. He has to become completely self-sustaining, or rely on a long and arduous journey into the nearest town for supplies. While he's traveling, he can't work, so he has to choose wisely. Imagine now that he's built up his farm and has attracted a neighbor. Now the two can specialize and between the two of them so much more time is saved than simply multiplying our initial man's time by two. This same phenomenon continues to get multiplied by each successive person.

Therefore, each person, when allowed to contribute, increases the entire communities wealth and productivity.

The Price of Land

However, notice what happens to the price of the plots of land. Notice that at first, the original man's land wasn't worth much at all. But as a town formed around him, the value of his land increased beyond that which he added to his land himself. Said more specifically, the value of the land increased even when the improvements on that land stayed the same. That extra price is created from humans ability to speculate (buy and hold).

If more folks wanted to join the town, they would have to go find the next available plot of land, or start buying others' plots. Now, here's where things get interesting.

Our first settler, while he worked on his farm (which we'll assume he claimed for cash) maintained 100% of his wages (the produce of the land) and didn't have to pay interest, or rent.

If we look at other settlers, maybe they bought someone else's land, and now they work for their wages minus the interest of capital or maybe they decide to rent someone's land since they know they can make more money having the rights to the land than the rent is worth. That equation would still subtract from their wages.

The last possibility would be that settlers might come and work on our settlers' land and get paid wages in return for their labor. They would be incentivized to do that until so many people were available to be hired by him that the wages go lower than they could make by claiming an even further plot of land and developing that plot themselves (though some people might be tied down geographically).

This plays out in the fact that poverty is greatest in the nations with the most wealth. In the places that people are paid the most, land is also the most expensive and the poverty level ($18,000 a year in the US) is raised substantially higher than less developed countries ($750 a year in Somalia).

Land as a Social Good

This is why George supposes that land should be thought of as a social good. A country only has so much land and one person's use of it is mutually exclusive to any others' use. Therefore, the use of land should be rented from the citizens of that country. Being that land is the origination of all wealth (ie. everything that exists that has any value was originally taken, farmed, mined, or harvested from land), if ownership of the medium for wealth creation was taxed no other tax would be needed. Henry George calls this, a "Land Tax" or "Single Tax."

Side note: It's worth talking about ideas. In Henry George's view, ideas are an input to labor, just as is skill, or creativity, but an idea itself cannot create any wealth.

The "Single Tax" would replace all other taxes, such as those on income, sales, and capital, which George believed discouraged productivity and penalized labor and capital investment. By taxing only land, George aimed to ensure that the value created by community development (like infrastructure, public services, etc.) would benefit everyone, not just landowners.

Taxing Land

You might be thinking...oh great, a "property" tax, we already have that, and it doesn't fulfill our tax needs as a nation. But this thinking, though in the same line, wouldn't do justice to George's idea.

He imagined a world where citizens couldn't own land, only own the right to rent it from the commons. A world where the price of land was tied solely to its productive value. How would this work? What would happen to people who currently own land? How could this transition happen?

Since obsoleting all ownership of land in one fell swoop would be HIGHLY controversial, Henry George proposed the idea that any rent, from here on out, for the cost of the unimproved land (as opposed to improvements made on the land) would be paid directly to the government.

If all the rent went straight to the government, would the debt that was used to purchase the land now be transferred to the government? If there's a distinction between land and its improvements, would there also be a distinction between rent that was owed for renting a unit in a building versus the rent owed to the landowner?

Henry George doesn't actually address compensation or renumeration for debts by the government. Though many believe he would not be a proponent of any compensation. This is where he losses me, as the economic blow this would create for individuals with mortgages for their land would be enormous. But let's take a look at this impact together.

An Example Landowner

For instance, imagine you bought unimproved land for $500,000 and had a mortgage on that for $450,000. You'd be paying about $2,500 per month to service that debt. Now, imagine Henry George gets his way, and all of a sudden the value of your land becomes whatever people are willing to pay for the productive use of the land which could, let's say, only be $50,000. You now are $450,000 in debt, with a bleed of $2,500 per month, and the land doesn't create any income for you. To break even you would need to at least find a way to make $30,000 per year using the land with your existing debt AND you'd also have to pay the government rent for the use of the commons (the land), which would be the full assessed market value of the land without improvements ($500,000 per year). So you'd have two options:

- Invest or borrow more money to make the land produce enough to keep it.

- Sell the right to work the land for the market rate, which may very well be a fraction of what you paid for it and continue to pay your debt on the difference.

- Abandon the land (which you've hopefully bought using an LLC) and allow your debts to default which would lead to the bank reclaiming their asset. This land would come with a $500,000 per year liability (the market rate) which would make the bank want to sell the right to work the land very, very quickly.

It seems that, in the end, the bank would be holding the bill, if you had protected yourself with an LLC or lived in a non-recourse state (ie. California, Texas, or Arizona). But in the 47 other states, this could very well end with the bank suing you for deficiencies, and you having to file for bankruptcy. Unless, however, with this new rule, we also made sure that mortgages defaulted on because of this rule would immediately become non-recourse mortgages.

The value of the land, and the right to work the land would be two different prices. The value of the land, which we currently identify using auditors would, in my opinion, take a massive dip because this value would be paid to the government yearly instead of paid to an individual for ownership. The right to work the land, which is what we normally refer to as the selling price would also take a substantive dip since now land would be a liability instead of an asset, however, the price for the improvements on the land would remain very much the same.

An Example Company

Let's take a look at a company buying land to build a factory. Let's say they paid $2 million dollars for the land, and built a factory worth $100 million dollars but borrowed $75 million. In our current system, they would pay property tax on the land, and the improvements (0.82% on average in Virginia) which would be about $826,400 per year in taxes + ~$385,000 per year in mortgage or ~$1.2 million a year.

In George's system, since the market value of the land would be $2 million dollars (which would go down over time as it's currently over-inflated due to speculation), that would be their yearly tax. They'd also have to service their debt for a total of about $2.4 million.

It seems to me that during the transition, land value would have to be updated monthly or quarterly since as a company, going from paying ~$400,000 in taxes to $2 million would be an incredible shock. Though, within a couple years, the entire system would reach a point of equilibrium where land would be cheaper to buy but more expensive to own.

[This system] would incentivize the productive use of land as opposed to the unproductive holding, and speculation of the single asset from which all wealth flows

The beauty in this system, as George sees it, is that it would incentivize the productive use of land as opposed to the unproductive holding, and speculation of the single asset from which all wealth flows.

Every land owner would have to become a producer or sell their land to someone who would use it productively.

This could be theoretically expanded to all commons (the air, seas, lakes and rivers, underground (minerals, oil), or the electromagnetic spectrum) within our country though most of them already do in one form or another.

The Economic Impact

Currently, the United States government takes in ~$4.4 trillion in taxes from income, property, social security, sales, excise, and capital taxes.

Concurrently, it's spending ~$6.2 trillion.

The current value of land in the United States that isn't federally owned is estimated about approximately $23 trillion. If you imagine that prices would stabilize, we could imagine a 4x reduction in land prices and still cover the total federal spending.

Conclusion

I LOVE this idea in theory, though I haven't fully understood how to implement it in reality. It would, in my mind, need some guardrails, some of which I've mentioned above. For instance:

- Potentially a rule alleviating the impact of mortgage defaults associated with this new system keeping banks from seeking recourse on their loans (or being okay with the impact)

- A transitional new audit rhythm as the market adjusts to the new prices and liabilities to keep companies and persons viable

- Someway to keep people from buying up land to ravage it then sell it back to the market (ie. deforesting a mountain for the wood without replanting) though this may be built in without me realizing it

- Who gets the money, counties? States? Or the nation? (This single thought could be an entire article in itself)

There's so much more to dive into with this system, but hopefully this article gives you a taste. Prosperity and Poverty is one of the densest but most eye opening treatise into the causes of inequality that I have ever read. It's filled with wisdom, beautiful allegories, and interesting facts and analyses into and of human nature. It's a book that, if you can suffer through it, reminds you of the power that humans have together instead of the constant idea that we've been indoctrinated with that other humans are the reason for your suffering. He shows how the more humans we have, the more productive we can be and if we remove the incentives for speculation and holding land hostage we can unlock a new level of productivity as a nation, and a new level of abundance as a people. Poverty is not a given, our system has created it as a by-product of our rules. Those rules and that system was created by us. We have, in effect, enslaved ourselves.